Free Resources

2026 Tax Deadlines

estimated tax payment due dates

Q1 - April 15, 2026

q2 - june 15, 2025

q3 - september 15, 2025

q4 - january 15, 2027

TAX FILING DEADLINES

S-Corp & Partnerships - March 16

Individuals & C-Corps - April 15

Avoiding an IRS Audit

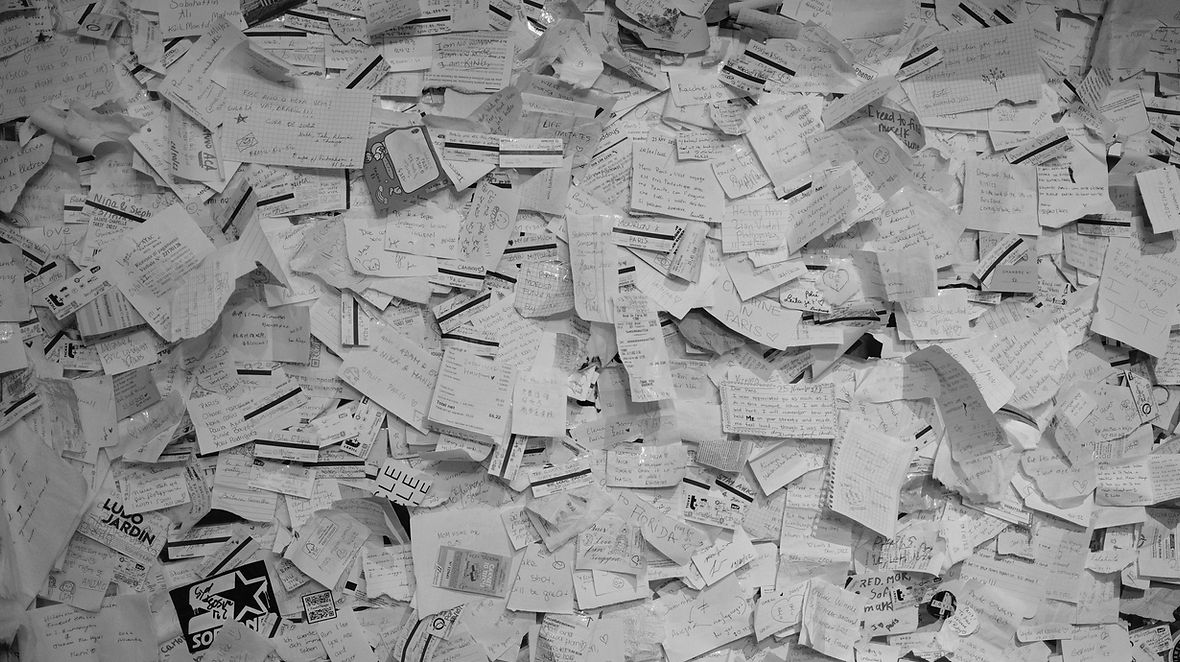

Where did your numbers come from?

-

Keep receipts for all expenses, either in paper form or digitally.

-

The easiest, most bulletproof system is to keep all of your physical receipts in a file.

-

Too much information is better than not enough information!

Be Extra Careful With High-Audit Expense Categories

-

Meals, travel, and mileage receive extra IRS scrutiny. For these types of expenses, keep records for each write-off. This will include when and where it occurred, who was in attendance, the purpose as it relates to your business, and a record of what was talked about.

-

Have a good mileage log if you deduct mileage - you’ll need accurate records that include mileage logs, dates, and the purpose of every trip.

-

Tip: Write on the back of each receipt: Name of client you were with, the business purpose/what you discussed and stick it in a file.

Keep Deductions Reasonable Relative to Income

The IRS compares deductions to averages for similar businesses and income levels. Unusually high deductions can trigger audits.

Stay on Top of Your Bookkeeping

-

Track income and expenses consistently throughout the year

-

Reconcile accounts monthly to make sure income is not duplicated and potential write-offs are not missing.

-

Keep personal and business expenses separate.

-

Make sure you report all income, take only proper deductions, and use reliable accounting software or consult with a bookkeeper to ensure all of your income, expenses, and documents are free of errors.

-

Accurate, well-documented bookkeeping is your best defense against IRS issues!